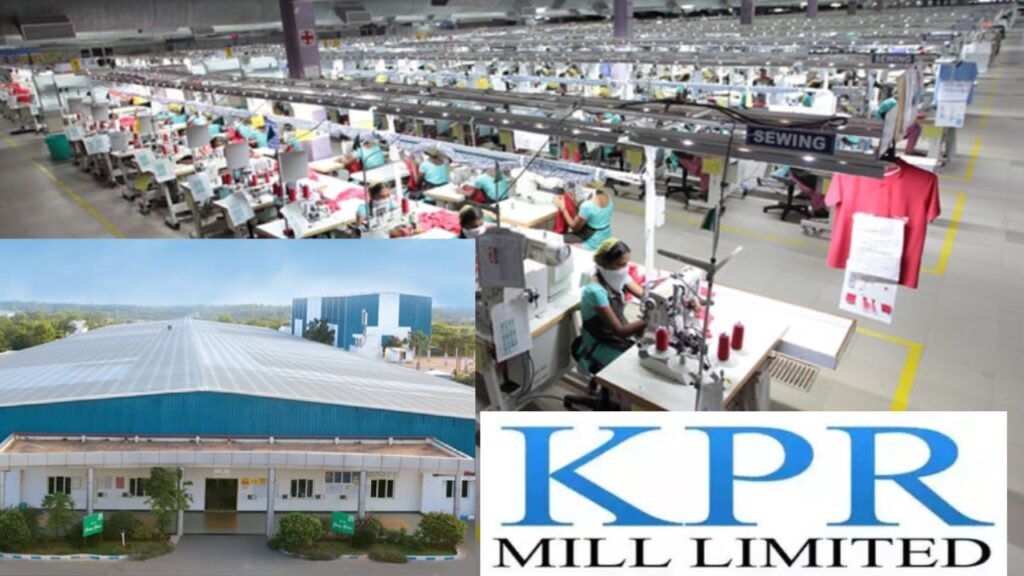

Company Overview

KPR Mill Ltd. ek vertically integrated textile and apparel company hai jo pure fabric-to-garment value chain mein operate karti hai—jisme yarn, knitted fabrics, ready-made garments, sugar, ethanol, cogeneration power, aur wind energy shamil hai. Company ka headquarters aur manufacturing facilities Tamil Nadu mein hain like Coimbatore, Tirupur aur Sathyamangalam.

Q1 FY26 Results

- Revenue (Total Income): ₹1,802 crore — YoY +11.4%, QoQ +1.2%

- Net Profit (PAT): ₹212.7 crore — YoY +4.6%, QoQ +3.98%

- PBT: ₹346 crore — YoY +7.6%

- EPS: ₹6.22 vs ₹5.95 last year

Seedha matlab: Growth modest hai, lekin consistency aur operational efficiency dikhta hai.

Recent News / Updates

- Tariff Tailwind: U.S. ne Bangladesh se imported goods par 35% duty lagaya, jis se KPR Mill shares me 4% surge dekha gaya.

- Strong FY25 Momentum: FY25 me company ne vertically integrated operations par focus badhaya aur growth momentum maintain kiya.

Peer Comparison

KPR Mill ek composite textile player hai. Iske peers hain Arvind Ltd., Vardhman Textiles, Page Industries, lekin:

- KPR ka edge: Strong vertical integration—from yarn to garments to sugar, ethanol, and renewable power.

- Peers zyada diversified material-wise ya fashion-forward hain; KPR niche positioning aur cost-control se stand out karta hai.

Seedhi baat—KPR ek “efficient value-chain textile specialist” hai jo sustainability aur self-reliance pe focus karta hai.

⚠️Risk Factors

- Raw Material / Energy Cost: Cotton price aur energy cost fluctuation profitability pe pressurize kar sakta hai.

- Cyclicality: Textile aur sugar sectors inherently cyclical hote hain—demand slow hone se impact ho sakta hai.

- Tariff Volatility: Export demand (e.g. U.S.) unstable ho sakta hai due to trade policy changes.

- Environmental Compliance: Textile units ko strict pollution norms follow karne padte hain—cost burden ho sakta hai.

🚀 Future Growth Outlook

- Product Diversification: Garments + Fabrics + Yarn + Sugar/Ethanol + Renewable Energy—company ke multiple revenue engines sustainable growth ko support karte hain.

- Export Tailwind: U.S. duty hike se export competitiveness improve hogi. Agar KPR strategically leverage kare toh mid-term me export growth visible ho sakta hai.

- Vertical Integration Efficiency: Own sugar/ethanol/wind power capabilities raw material aur energy cost control me madadgar sabit hote hain.

- Operational Expansion: New capacity (garment, yarn, energy) aur digital efficiency ke sath margins aur stabilize ho sakte hain.

- Financial Stability: Steady profits aur balanced cost structure long-term sustainability ke liye positive signal hai.

Aam shabdon mein: KPR Mill, apni strong vertical chain, cost efficiency aur export tailwinds ke sath, long-term me ek resilient compounder stock banne ki potential rakhta hai.

Investor Perspective

- Short Term: Modest growth + tariff benefits se strong sentiment; stock me stability dekhne ko mil sakti hai.

- Medium Term: Capacity expansions aur power cost savings se margins improve honge.

- Long Term: Vertical integration aur diversified portfolio se KPR ek steady growth engine sabit ho sakta hai.

❓ FAQs

Q. KPR Mill ka iska business kya hai?

- 👉Yarn, fabrics, garments, sugar, ethanol, cogeneration power and wind energy—from textiles to integrated agro/renewable value chains.

Q. Q1 FY26 me result kaisa raha?

- 👉Revenue ~₹1,802 cr (+11%), PAT ~₹212.7 cr (+4.6%), EPS ₹6.22.

Q. Future growth driver kya hai?

- 👉Vertical integration, export competitiveness, renewable energy & ethanol integration, and operational efficiency.

Conclusion

KPR Mill ek robust, integrated textile and agro-power play hai jiska Q1 performance stable raha. Vertical chain, export tailwinds, and green energy positioning ise long-term me ek sustainable growth stock banate hain. Agar execution sahi rahe to ye ek aacha long-term hold ho sakta hai.

⚠️Disclaimer

Yeh post educational/informational purpose ke liye hai. Stock investments risk ke saath aate hain—investment decisions se pehle apne financial advisor se consult zaroor karein.